Nebraska Sports Betting Bill Would Overhaul Market, Authorize Online Wagering

20 Jan 2025

A bill has been introduced in the Lincoln capital of Nebraska aiming to broaden sports betting to online platforms.

On Friday of last week, state Senator Stanley Clouse (R-Buffalo) put forth Legislative Bill 421. The proposal aims to modify Nebraska's gaming legislation to permit online sports betting.

LB421 would permit each of the state’s six commercial casinos to operate one online sportsbook skin independently or in partnership with a third-party operator such as DraftKings and FanDuel.

Every racetrack casino aiming to enable online betting must pay a one-time licensing fee of $5 million, which can be paid over five years. Yearly renewals would be $50,000. Bookmakers would allocate 20% of their total earnings to the state.

Clouse indicates that 3% of the state tax revenue from online sports betting is allocated to the Compulsive Gamblers Assistance Fund — 0.5% more than the 2.5% it gets from other gambling sources. The reason the state legalized retail slot machines, table games, and sports betting was to support the Nebraska Property Tax Credit Cash Fund, which would gather 90% of the taxes from online betting.

Enhancing Assistance

In 2020, voters in Nebraska approved a state ballot measure allowing casinos at horse racetracks with state licenses. In addition to rejuvenating the horse racing sector, the choice to introduce Las Vegas slot machines and table games, along with sportsbooks, to the Cornhusker State aimed to lessen property taxes for homeowners.

Out of every dollar collected by the state from slot machines, table games, and live sports wagers, 70 cents are allocated to the Property Tax Credit Cash Fund. To enhance the relief for homeowners through the legalization of gambling, online sports betting is essential.

In jurisdictions where both online and in-person sports betting is allowed, most of the activity occurs online. In New Jersey, for example, out of the $12.77 billion wagered last year, over $12.27 billion, which is 96%, was placed remotely using internet-connected devices.

In 2024, New Jersey's retail sportsbooks produced under $2.9 million in state tax income. Online sportsbooks allocated more than $358.3 million to Trenton.

Clouse thinks the 2020 referendum permits the state Legislature to broaden gambling to encompass online sports betting without needing an additional referendum.

"[Online sportsbooks] would be tied into the brick and mortar casinos that have been approved by the voters,” Clouse said.

Last year, Sen. Eliot Bostar (D-Lincoln) supported a bill that would have sought voter approval for internet sportsbooks. His proposal, however, came to a halt after gaining backing in the Unicameral General Affairs Committee.

Expected Earnings

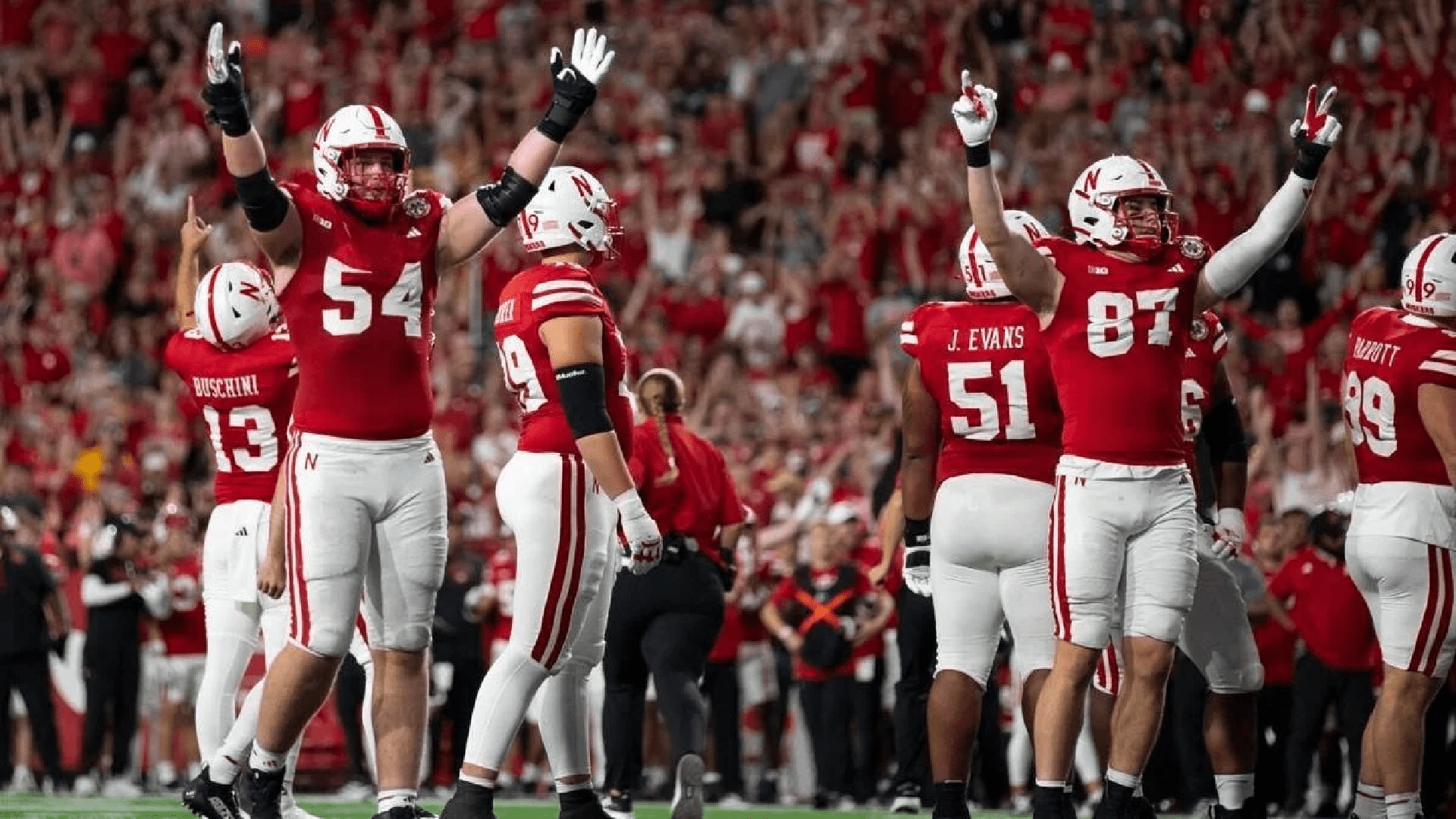

In addition to introducing online sports betting, Clouse’s bill would remove a clause in the state’s existing sports betting law that stops oddsmakers from accepting bets on games featuring in-state colleges. Permitting wagers on the Nebraska Cornhuskers, Creighton Bluejays, and other colleges would probably result in a significant rise in betting and discourage some bettors from crossing into surrounding states to make those college wagers.

Nebraska's Legislative Fiscal Office estimates that the state might generate approximately $32 million each year from a fully developed online sports betting market. Governor Jim Pillen (R) is dedicated to reducing property taxes for homeowners and would likely approve an online betting bill if it arrives at his desk.

Category: